Manashimaya

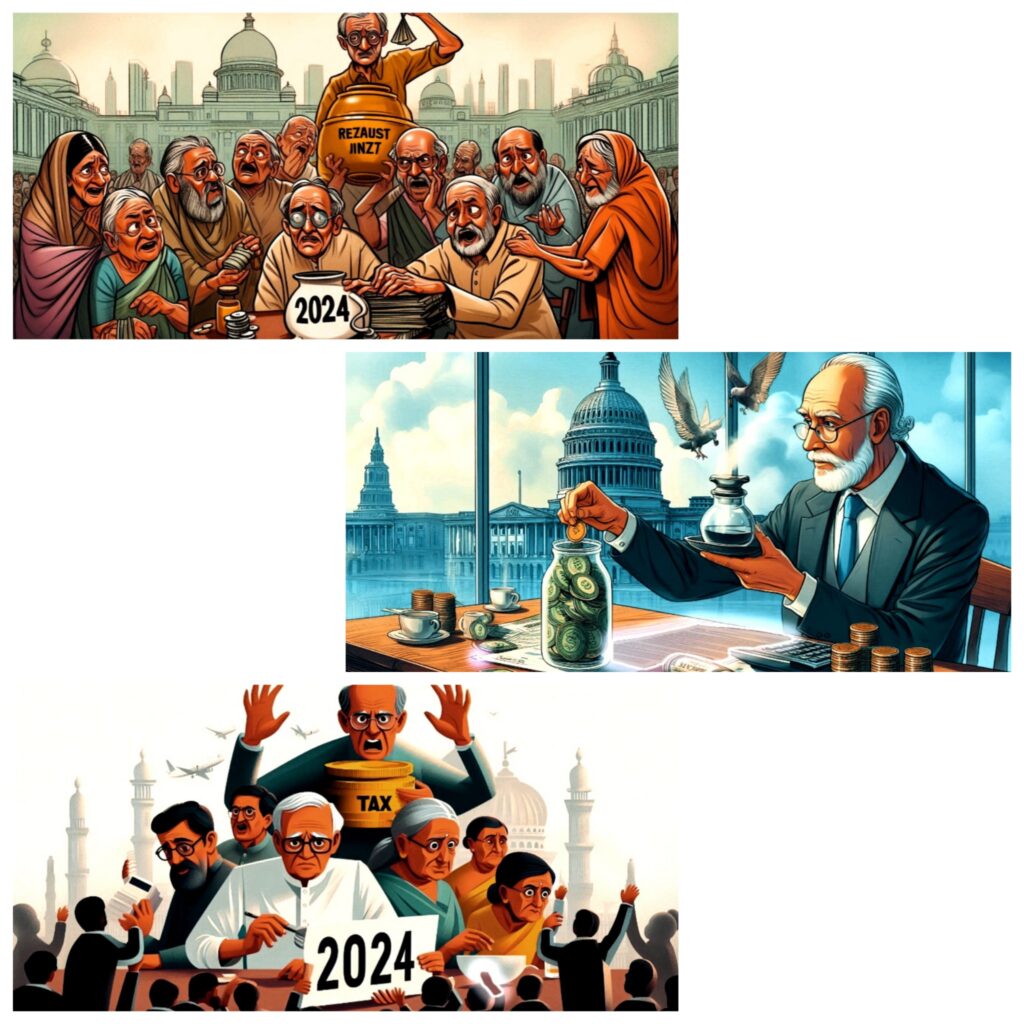

As the Union Budget for 2024-25 is set to be tabled on July 22, senior citizens in India are vocalising their hopes for much-needed tax relief. Senior citizens urge the easing of tax laws in the 2024 budget to alleviate financial strain, highlighting their significant contribution to the tax-paying demographic through various income sources, often passive in nature.

One of the primary demands from senior citizens is an increase in the threshold for mediclaim premium deductions. The provisions allow for a deduction of Rs 50,000 concerning any mediclaim premium or medical expenditure incurred by a senior citizen. However, given the escalating medical costs, senior citizens urge easing of tax laws in the 2024 budget to alleviate financial strain by raising this limit to Rs 1 lakh. Suresh Surana, a practicing chartered accountant, conveyed to the Economic Times the pressing need for this adjustment to help seniors manage their healthcare expenses more effectively.

In addition, seniors are requesting that Section 194P of the Income Tax Act be amended to reduce the age requirement for filing income tax returns from 75 to 60 years old. Senior persons 75 years of age and older are currently excluded from filing income tax returns, under certain restrictions. Seniors want the 2024 budget to loosen tax regulations by lowering the age limit to 60 years old. This will relieve financial burden and spare them the headache and anxiety that comes with filing taxes.

Another significant expectation is the rationalisation of the lock-in period for investments under Section 80C. Presently, investments in fixed deposits with banks or post offices, National Savings Certificates (NSC), and equity-linked savings schemes (ELSS) qualify for deductions under Section 80C, but they are subjected to lock-in periods ranging from 3 years for ELSS to 5 years for NSC and fixed deposits. Senior citizens urge the easing of tax laws in the 2024 budget to alleviate the financial strain by reducing these lock-in periods, providing them with greater financial liquidity to address their health and well-being needs.

Additionally, senior citizens are advocating for a gross deduction for rent, especially for those without substantial income. Neeraj Agarwala, a partner at Nangia Andersen India, emphasised to the Economic Times the importance of addressing the rising cost of living for the elderly. By recognising this need, senior citizens urge the easing of tax laws in the 2024 budget to alleviate financial strain, ensuring a more secure and stable living environment for them.

Exemptions on passive income sources such as rent, interest from savings accounts, fixed deposits, and bonds are also high on the senior citizens’ wishlist. They expect the government to introduce higher exemptions or lower tax rates on these income sources. Senior citizens urge the easing of tax laws in the 2024 budget to alleviate financial strain, allowing them to maintain their standard of living without the constant worry of tax liabilities.

Finally, there is a call for incentivising senior citizen taxpayers. By offering benefits like reduced healthcare costs, subsidised utilities, or exclusive access to financial products tailored for seniors, the government can acknowledge and reward the fiscal responsibility of its elderly citizens. Senior citizens urge the easing of tax laws in the 2024 budget to alleviate financial strain, fostering a sense of appreciation and support for their contributions.

In conclusion, as the Union Budget 2024-25 approaches, the government must consider these reasonable and crucial demands. Senior citizens urge the easing of tax laws in the 2024 budget to alleviate financial strain, ensuring a dignified and secure financial future for the elderly population of India.